Backbar has released on-premise inventory data showing which hard seltzer brands are gaining market share, the flavors and innovative products inspiring growth

CHICAGO, IL. -- A new release of on-premise hard seltzer data from Backbar, the largest alcohol inventory management platform for bars and restaurants, shows that White Claw is down 15.4 share points in the first two quarters of 2021. Backbar, which is used by over 10,000 businesses to streamline beverage operations, analyzed data on inventory market share for the hard seltzer segment. In 2020, White Claw products accounted for 60.4% of the hard seltzer inventory for on-premise accounts. Data from June 2021 shows White Claw's market share dropped to 45% of all hard seltzer inventory.

White Claw Hard Seltzer products still dominate the on-premise sector, with White Claw Black Cherry (13.2%) and White Claw Mango (9.22%) making up the top two products in market share. White Claw Natural Lime (3.46%), White Claw Raspberry (3.33%) and White Claw Ruby Grapefruit (3.33%) all fall within the top 10 products by share.

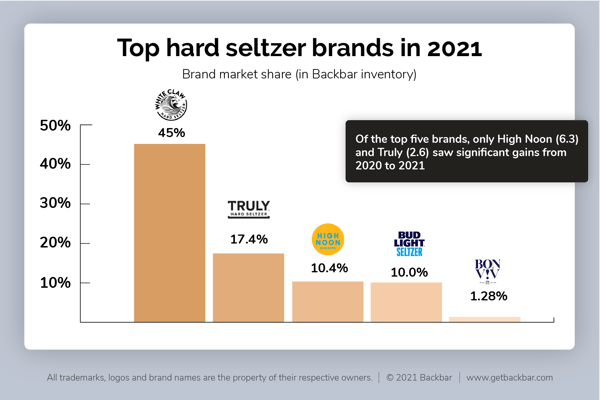

The top five hard seltzer brands in Backbar are White Claw (45%), Truly (17.4%), High Noon Spirits Company (10.4%), Bud Light Seltzer (10%), and Bon & Viv (1.28%). High Noon saw the largest gain of share points year-of-year, growing by 6.3 points in 2021. Of the top five brands, only High Noon (6.3) and Truly (2.6) saw significant gains from 2020 to 2021. Bon & Viv saw a gain of .2 share points in the same period. Along with White Claw's loss of inventory market share, Bud Light Seltzer has experienced a loss of 1.9 points so far in 2021, compared to 2020. Bud Light Seltzer launched in January 2020 and saw impressive sales behind major marketing efforts.

Backbar data shows that High Noon and Truly's market gain has been driven by new, innovative releases. Truly's growth has come through its Lemonade product line, led by its Strawberry Lemonade offering and the successful launch of its Punch product line. High Noon's tropical flavors (Pineapple and Watermelon) drove its growth, appealing to bar operators and consumers with the seltzer's brand position of "real vodka + real fruit juice."

The citrus flavor segment has experienced a steady decline in popularity since 2019. Though White Claw Natural Lime is the third most represented product in market share, it lost 8.3 share points since 2019. The decline of citrus flavor is seen across the entire hard seltzer category. The Lime flavor category as a whole, dropped from 15% (2019) to. 7.5% (2021) while Grapefruit has fallen from 15% (2019) to 6.6% (2021).

As the Hard Seltzer segment looks to continue its impressive growth through 2021, more brands are releasing new product lines and expanding the options. White Claw Hard Seltzer Iced Tea hasn't made an impact yet in Backbar's on-premise data. Bud Light has released two new products in 2021, following released by Truly and White Claw with Bud Light Hard Seltzer Lemonade and Bud Light Hard Seltzer Ice Tea.

About Backbar

Backbar is the largest and fastest-growing beverage operations software for restaurants and bars. Over 10,000 businesses rely on Backbar to manage their inventory, purchasing, vendor management, and costing. Backbar is a cloud-based platform available on the web and mobile devices to help restaurants and bars consolidate the management workflow, control costs, operate more efficiently, and run a more profitable business.